Slack Technologies Inc. (NYS: WORK) Stock Analysis

- WinInStocks

- Feb 6, 2020

- 6 min read

Updated: Aug 4, 2020

Current price:

Price on date of analysis: $23.31

Market cap: $12.77B

Overall assessment: HOLD

Why did it pique my interest?

Slack Technologies shares are trading sharply higher on Tuesday after RBC Capital analyst Alex Zukin picked up coverage of the stock with an Outperform rating and $25 target price. https://www.barrons.com/articles/slack-stock-surges-on-rbc-analysts-bullish-call-51580839938?siteid=yhoof2&yptr=yahoo

Sales are growing 80%-100% every year, and I am always interested in such massive growth companies.

The product is quite interesting.

Overview: company, category description

Slack Technologies Inc. operates Slack, a business technology software platform primarily in the United States and internationally. Its platform sells a software-as-a-service model. Slack Technologies Inc. is based in San Francisco, California.

Slack already has 16 offices around the globe: 8 in North America, 4 in Europe, 2 in Australia, 1 in Japan, and 1 in India.

The stock price declined from $40 since the company IPO to $22. However, in the past few months, the stock was running in a side channel between $19.67 and $24. It seems investors are waiting for the company to make the next move and are undecided on stock value.

Financial overview

Below are extracts from Slack Technologies Inc.'s management presentation for the latest quarterly results (with guidance for full 2020).

“Revenue growth was 60% year-over-year, driven by strong growth upmarket,” said Allen Shim, Chief Financial Officer at Slack. “We ended the quarter with 821 Paid Customers greater than $100,000 in annual recurring revenue, which is up 67% year-over-year. We also exceeded 50 Paid Customers with greater than $1 million in annual recurring revenue for the first time, an indication that large enterprises are increasingly standardizing on Slack as their primary collaboration platform.”

Third Quarter Fiscal 2020 Financial Highlights: • Total revenue was $168.7 million, an increase of 60% year-over-year.

• GAAP operating loss was $95.0 million, or 56% of total revenue, compared to a $50.8 million loss in the third quarter of the fiscal year 2019, or 48% of total revenue. Non-GAAP operating loss was $18.1 million, or 11% of total revenue, compared to a $39.6 million loss in the third quarter of the fiscal year 2019, or 37% of total revenue.

Financial Outlook: For the fourth quarter of the fiscal year 2020, Slack currently expects: • Total revenue of $172 million to $174 million, representing year-over-year growth of 41% to 43%. • Non-GAAP net loss per share of $0.07 to $0.06, assuming weighted average shares outstanding of 550 million.

For the full fiscal year 2020, Slack currently expects: • Total revenue of $621 million to $623 million, representing year-over-year growth of 55% to 56%. • Non-GAAP net loss per share of $0.32 to $0.31, assuming weighted average shares outstanding of 399 million. • Free Cash Flow net burn of $85 million to $80 million

Sales grew 109% in 2018, 82% in 2019. Currently, SG&A expenses are growing also quickly at 42-49%. However, the company has yet to have a profitable quarter. The key to company profitability is:

Continue to show strong revenue growth

Start to slow down SG&A expenses increase, which normally happens as the company grows.

Unfortunately, the company is at a stage of development when it is almost impossible to predict when it will get to profitability. Current sales are too low for the expenses; expenses keep rising as they add more offices/staff and we don’t know when they will cap expenses. However, we will try to come up with an estimate as we need it to calculate the stock price. Below are the company’s income statements for the past 4 quarters as well as yearly statements for the past 3 years. As you can see, the company was growing very quickly over the past 3 years (109% in 2018, 82% in 2020); however, in the most recent year, the growth slowed to just 10-16% per quarter (average 12.48%). This will provide only a 60% growth year over the year. While this growth is not bad, it is worrying that the pace of the growth decreases year after year.

Also, the company was growing its SG&A expenses at 42%-49% per year between 2017 and 2019 which is understandable: the company is opening new offices, hiring staff. However, in Q2 2019, in just one quarter, the company suddenly doubled the costs. In Q4, the cost declined to $240M, but it is still above Q2 numbers by 55%. The company must decrease its expenses growth as with current Sales growth; it will not see a profit for like 20 years.

For our estimate, we will assume that the company will continue to grow Sales at 57%. The gross margin for the company was growing as much as sales: we will assume 57% as well. We also assume that the company has opened all the offices it needs for the next few years and the SG&A expenses will grow at 26% a year. Also, we will assume the company will not be issuing any new stocks as it just did an issue in Q4 2019. Under these assumptions, if there is no sudden growth or declines in sales, the company should see profit in 2023 which will start with $0.26 EPS but will grow quickly to $1.22 in 2024 and $2.92 in 2025. At that moment, the company yearly sales must be at $6B which is possible, but usually at that moment companies start to slow down in growth.

Now, likely when the company will be at the beginning of 2022, investors will start to realize the company is about to become profitable and the stock price will increase. However, I would hold on this stock until the end of 2021-beginning of 2022 to see whether it can grow at 57-60% every year.

The moment the Gross Income outpaces Expenses is when the company will get profitable:

The current market cap is 12.77B and assuming a PE of 30; the company must make $425M in profits to justify the price which will happen between 2023 and 2024. I am not taking into consideration the time value of the money as it is going to complicate things too much.

Key financial ratings/Stock Value

Analysts think the target price for the stock is $27.32.

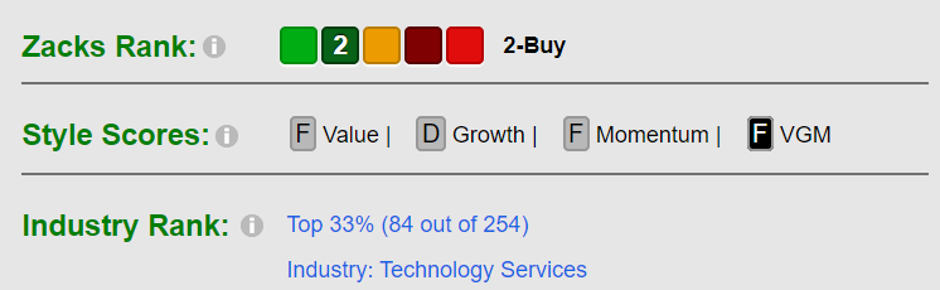

Ratings by analysts, Zacks

Zacks thinks the stock is a buy. There were 22 analysts that analyzed the stock. Of them, 9 say it is a Strong Buy, 2 – Buy, 9 – Hold, 2 – Strong Sell.

Who owns it? Changes in ownership

Institutional investors are absorbing as much of the stock as they can. There is still some float as they own only 63% of it, but there is a surge of investors buying the stock. This is positive for the company. The stock may appreciate in the next couple quarters as the demand will start outpacing supply at current prices.

Buzz (StockTwits)

There is a lot of buzz about the stock on StockTwits. The sentiment is quite positive.

Risks

Overall, the company is showing a lot of potential and good growth. However,

Currently, sales are too much behind company expenses. It will take some time for sales to grow to outgrow expenses.

The company sales growth is slowing year-after-year.

There is inconsistency in SG&A expenses (likely due to opening new offices); however, each time expenses go up the moment of profitability is further delayed (unless expenses increase the rate of sales growth, which we don’t yet see).

The company is burning cash and issuing new stocks to raise financing.

Assuming the rate of sales growth does not slow, and the rate of SG&A expenses slows down, the first profitable year is expected in the middle of 2023. A lot may happen with the company between now and then.

Overall assessment and summary

I completely understand how WORK investors have high hopes for the company as if the Slack Technologies solution will truly become the next email, the company will sit on billions of dollars and will be the next Microsoft. However, I am not an investor and looking at this from a side of “should I buy – should I not.”

Overall, I don’t like the company for slowing the growth of sales this early. If the product that great it should sell itself at this moment. The company will likely be going to be at the mercy of fighting bulls and bears for the next couple of years with a lot of volatility in the price. Personally, I also don’t want to wait until 2023 to see a profitable year (if it even happens). There is also too much risk and uncertainty as the planning into 2023 is risky. The stock price is also overpriced.

However, if you have extra cash to just throw in it (win or lose) and don’t touch that money for the next 3-4 years, then definitely, go ahead.

My rating: HOLD

Have an idea about Slack Technologies Inc. (NYS: WORK) ? You have a different opinion about this stock? I made an error in assumptions? You have additional information to share? Please leave your comments below.

Comments